In every business, accurate record-keeping is critical to smooth operations. Among the essential documents used in procurement, inventory management, and accounting is the receipt note. Often overlooked, a receipt note plays a vital role in confirming the delivery of goods, tracking inventory, and avoiding disputes with suppliers.

What is a Receipt Note?

A receipt note (RN) is an official document issued by the receiving department or party to acknowledge that goods, materials, or services have been received from a supplier. It serves as proof that the items delivered match the purchase order and are received in acceptable condition.

It is important to understand the distinction between similar business documents:

| Document | Purpose |

|---|---|

| Invoice | Issued by the supplier to request payment |

| Delivery Note | Sent by supplier to confirm dispatch of goods |

| Receipt Note | Created by the receiver to confirm receipt |

In essence, the receipt note confirms that goods have physically arrived at the buyer's location and that they meet the agreed specifications.

Purpose of a Receipt Note

Receipt notes serve several critical functions in business operations:

- Proof of Receipt: Confirms that goods delivered by the supplier have been received.

- Verification Against Purchase Orders: Helps ensure the correct items and quantities were delivered.

- Inventory Management: Facilitates accurate stock updates and prevents inventory discrepancies.

- Quality Control: Provides a record for inspecting goods for defects, damages, or shortages.

- Dispute Resolution: Acts as evidence during supplier disputes or audits.

- Accounting and Auditing: Supports financial record-keeping and compliance with regulatory standards.

For example, if a company orders 100 units of a product and receives only 95, the receipt note serves as proof to request the remaining 5 units or claim a refund.

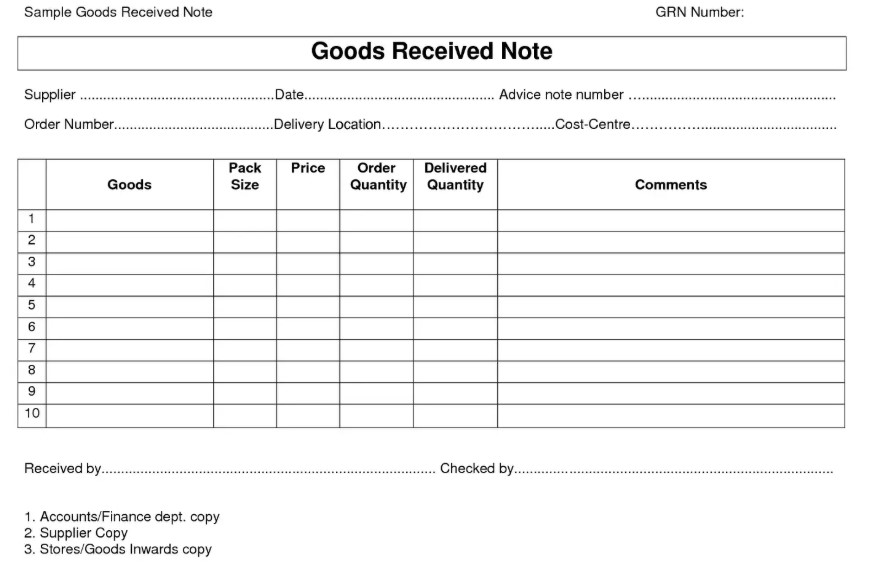

Components of a Receipt Note

A well-structured receipt note should contain all relevant information to avoid confusion and discrepancies. Key components include:

- Supplier Information: Name, address, contact number, and tax details.

- Receiver Details: Name of the company or department receiving the goods.

- Receipt Date: Date on which the goods were received.

- Purchase Order Number: Links the receipt to the original order for verification.

- Item Description: Product name, code, quantity, unit, and specifications.

- Condition of Goods: Notes on damaged, defective, or missing items.

- Authorized Signatures: From personnel receiving and inspecting the goods.

- Remarks/Notes: Any special instructions, issues, or observations.

Example Receipt Note Table:

| Supplier | XYZ Suppliers Pvt Ltd |

|---|---|

| Receiver | ABC Company |

| Date | 05-09-2025 |

| PO No. | PO-12345 |

| Item Name | Quantity | Unit | Condition | Remarks |

|---|---|---|---|---|

| Widget A | 50 | pcs | Good | None |

| Widget B | 30 | pcs | Damaged | Packaging torn |

| Receiver Signature | __________ |

Types of Receipt Notes

Receipt notes can vary depending on the business requirements:

- Standard Receipt Note: Basic documentation for receiving goods.

- Goods Received Note (GRN): Common in warehouses; includes detailed verification for inventory management.

- Digital Receipt Note: Generated and stored electronically through ERP or inventory software.

- Specialized Receipt Notes: Used for returns, partial deliveries, or damaged goods.

Each type serves the purpose of tracking inventory while ensuring accountability.

Step-by-Step Guide to Creating a Receipt Note

Creating an accurate receipt note involves several steps:

- Record Supplier and Receiver Details: Include all relevant company information.

- Cross-Verify Purchase Order: Ensure the delivery matches the original PO in terms of quantity, specifications, and product codes.

- Inspect Goods: Check for damages, defects, or missing items.

- List All Items Received: Provide detailed descriptions, quantities, units, and condition.

- Add Notes for Discrepancies: Mention damaged, missing, or surplus items.

- Obtain Authorized Signatures: From both receiving and inspecting personnel.

- Store Copies: Keep both digital and physical copies for auditing purposes.

Importance in Accounting and Auditing

Receipt notes are vital for financial and operational management:

- Support Accounting Records: Confirms purchases and inventory receipts for accounting.

- Facilitate Audits: Serves as proof of goods received during internal and external audits.

- Prevent Fraud and Errors: Reduces the risk of receiving incorrect or unauthorized goods.

- Regulatory Compliance: Ensures the company adheres to legal and tax requirements.

For example, during a financial audit, receipt notes help verify that purchases recorded in accounting books match actual stock.

Common Mistakes to Avoid in Receipt Notes

Errors in receipt notes can lead to stock discrepancies, financial loss, and disputes. Common mistakes include:

- Missing or incorrect supplier or PO details.

- Delayed recording of received goods.

- Failure to verify goods against purchase orders.

- Ignoring damaged or missing items.

- Not retaining copies for future reference.

Tip: Always cross-check details immediately upon receipt and maintain both digital and physical copies.

Digital Solutions for Receipt Notes

Technology has made managing receipt notes easier and more accurate:

- ERP Software: Tools like SAP, Tally, Zoho Inventory, and QuickBooks allow automated creation and storage of receipt notes.

- Benefits:

- Reduces human errors and manual work

- Enhances traceability of inventory

- Simplifies reporting and auditing

- Provides instant access to historical records

Digital receipt notes are increasingly becoming the industry standard due to efficiency, accuracy, and ease of compliance.

Best Practices for Receipt Notes

To maximize the effectiveness of receipt notes:

- Standardize Formats: Use consistent templates for easy tracking.

- Inspect Immediately: Check items before signing off.

- Update Inventory in Real-Time: Reduce discrepancies by promptly recording received goods.

- Train Staff: Ensure personnel understand the importance of accurate receipt notes.

- Keep Records Safe: Maintain both digital and hard copies for audits and legal purposes.

A receipt note is not just a formality; it is a crucial document for operational efficiency, inventory management, and accounting accuracy. Properly maintained receipt notes reduce errors, prevent disputes, and provide a transparent record of all goods received.

Adopting digital solutions and following best practices ensures that receipt notes fulfill their purpose effectively, supporting both day-to-day operations and long-term business growth.

VyapaarKhata

Simplify your business accounting and invoicing with ease

Key Features & Benefits

- Professional Invoicing: Create GST-compliant and customizable invoices quickly.

- Expense Management: Track daily expenses and categorize them for easy analysis.

- Payment Tracking: Monitor pending and received payments to improve cash flow.

- Digital Record Keeping: Maintain organized digital records of all transactions.

- Inventory Management: Keep track of stock levels and manage products efficiently.

- Real-Time Reports: Generate instant financial reports for better decision-making.

- User-Friendly Interface: Simple design suitable for business owners with no accounting experience.

- Multi-Language Support: Available in multiple Indian languages for local businesses.

- Compliance Ready: Helps businesses stay compliant with GST and tax regulations.

- Mobile Access: Manage your business on-the-go with mobile-friendly features.

FAQs About Receipt Notes

Q1: What is the difference between a receipt note and an invoice?

A: An invoice requests payment from the buyer, while a receipt note confirms that the goods have been received.

Q2: Can a receipt note be used as legal proof?

A: Yes, it serves as evidence in disputes regarding delivery, quantity, or quality of goods.

Q3: How long should receipt notes be stored?

A: Generally, businesses retain receipt notes for 5–7 years for auditing and regulatory compliance.

Q4: Can digital receipt notes completely replace manual notes?

A: Yes, digital receipt notes are widely accepted, provided they are securely stored and backed up.

Q5: Should damaged goods be noted immediately?

A: Absolutely. Any damage or discrepancy should be documented on the receipt note and reported to the supplier immediately.